How to Send and Receive Cryptocurrency Securely

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have revolutionized finance, enabling peer-to-peer transactions without intermediaries.

As of August 3, 2025, with Bitcoin trading between $50,000 and $80,000 and Ethereum targeting $4,000–$6,000, securely sending and receiving crypto is critical for protecting your assets.

The decentralized nature of blockchain ensures robust security, but human errors, scams, and hacks can lead to significant losses. This article provides a step-by-step guide to sending and receiving cryptocurrency securely, covering wallet setup, transaction processes, and best practices to safeguard your funds.

Understanding Cryptocurrency Transactions

Cryptocurrency transactions occur on a blockchain, a decentralized ledger that records all transfers. To send or receive crypto, you need a crypto wallet, which stores private and public keys:

-

Public Key/Address: A unique string (e.g., 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa for Bitcoin) used to receive funds, similar to a bank account number.

-

Private Key: A secret code that authorizes sending funds, like a password. It must remain confidential.

-

Seed Phrase: A 12–24-word backup for recovering your wallet if the private key is lost.

Transactions are irreversible once confirmed on the blockchain, making security paramount. Mistakes, such as sending to the wrong address or exposing your private key, can result in permanent loss.

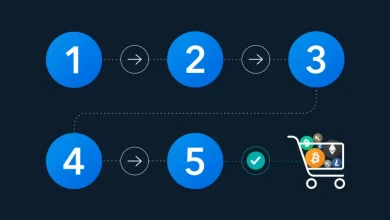

Step-by-Step Guide to Sending Cryptocurrency Securely

Step 1: Choose a Secure Wallet

Select a wallet based on your needs:

-

Hot Wallets: Software-based, online (e.g., MetaMask, Trust Wallet). Ideal for frequent transactions but less secure.

-

Cold Wallets: Hardware-based, offline (e.g., Ledger Nano X, Trezor). Best for large amounts or long-term storage.

-

Custodial Wallets: Managed by exchanges (e.g., Coinbase, Binance). Convenient but rely on the provider’s security.

Action: For beginners, start with a hot wallet like Trust Wallet for small transactions. For larger amounts, invest in a hardware wallet.

Step 2: Set Up and Secure Your Wallet

-

Download the wallet from its official website or app store to avoid fake apps.

-

Follow setup instructions to generate a private-public key pair and a seed phrase.

-

Write down the seed phrase on paper or engrave it on metal and store it in a secure, offline location (e.g., a safe or bank vault).

-

Enable two-factor authentication (2FA) using an authenticator app (e.g., Google Authenticator) for hot or custodial wallets.

-

Never store your seed phrase or private key digitally (e.g., in cloud storage or screenshots).

Action: Set up a wallet, record the seed phrase offline, and enable 2FA. Test recovery with the seed phrase on a secure device.

Step 3: Obtain Cryptocurrency

If you don’t own crypto, purchase it through a reputable exchange:

-

Centralized Exchanges (CEXs): Coinbase, Binance, or Kraken allow buying with fiat (USD, EUR) via bank transfer or card.

-

Decentralized Exchanges (DEXs): Uniswap or PancakeSwap require existing crypto and a non-custodial wallet.

-

Peer-to-Peer (P2P): Platforms like LocalBitcoins connect you with sellers directly.

Action: Buy a small amount (e.g., $50 of BTC or ETH) on Coinbase or Binance after completing KYC verification. Transfer it to your wallet.

Step 4: Prepare to Send Crypto

-

Verify the Recipient’s Address: Obtain the recipient’s public address (e.g., via QR code, copy-paste, or manual entry). Double-check it, as errors are irreversible.

-

Confirm Blockchain Compatibility: Ensure the address matches the cryptocurrency’s blockchain (e.g., don’t send BTC to an ETH address).

-

Check Network Fees: Transactions require fees (e.g., Bitcoin’s miner fees or Ethereum’s gas fees). Higher fees speed up confirmation.

Action: Ask the recipient for their wallet address and verify it matches the intended crypto (e.g., BTC for Bitcoin, ETH for Ethereum).

Step 5: Send the Transaction

-

Open your wallet and navigate to the “Send” or “Transfer” section.

-

Enter the recipient’s address, amount, and (if applicable) a memo or destination tag (e.g., for XRP or Stellar).

-

Adjust the transaction fee if your wallet allows (higher fees for faster confirmation, lower for cost savings).

-

Review the details carefully, ensuring the address and amount are correct.

-

Authorize the transaction using your private key (automatically handled by the wallet) or enter a PIN for hardware wallets.

-

Submit the transaction to the blockchain network.

Action: Send a small test transaction (e.g., $10) to confirm the process works before transferring larger amounts.

Step 6: Confirm the Transaction

-

Monitor the transaction status using your wallet or a blockchain explorer (e.g., Blockchain.com for Bitcoin, Etherscan for Ethereum) by entering the transaction ID (TXID).

-

Confirmation times vary: Bitcoin takes 10–60 minutes, Ethereum 15 seconds to 5 minutes, depending on fees and network congestion.

Action: Track your transaction on a blockchain explorer and notify the recipient once confirmed.

Step-by-Step Guide to Receiving Cryptocurrency Securely

Step 1: Share Your Wallet Address

-

Open your wallet and locate your public address under the “Receive” or “Deposit” section.

-

Copy the address or display its QR code for the sender to scan.

-

Ensure the address corresponds to the correct blockchain (e.g., BTC for Bitcoin, not ETH).

-

For some coins (e.g., XRP), provide a destination tag if required by the sender’s platform.

Action: Share your address via a secure channel (e.g., encrypted messaging like Signal) to avoid interception.

Step 2: Verify Receipt

-

Wait for the sender to initiate the transaction.

-

Check your wallet or a blockchain explorer to confirm the funds arrive (confirmation times vary by blockchain).

-

Notify the sender once the transaction is confirmed.

Action: Monitor your wallet balance and confirm receipt with the sender.

Best Practices for Secure Transactions

-

Double-Check Addresses: Always verify the recipient’s address character-by-character or use QR codes to avoid errors or phishing scams.

-

Use Secure Channels: Share addresses via encrypted platforms, not unsecure ones like email or SMS.

-

Test Small Transactions: Send a small amount first to confirm the address is correct before transferring large sums.

-

Secure Your Private Key and Seed Phrase: Store them offline in multiple secure locations (e.g., a safe, bank vault). Never share them.

-

Enable 2FA: Use authenticator apps for hot wallets and exchange accounts to prevent unauthorized access.

-

Avoid Public Wi-Fi: Don’t send transactions over unsecured networks, as they’re vulnerable to man-in-the-middle attacks.

-

Verify Platforms: Download wallets and access exchanges from official sources to avoid fake apps or phishing sites.

-

Use Hardware Wallets for Large Transactions: Transfer significant amounts from a cold wallet for maximum security.

-

Stay Updated: Monitor wallet software updates and security advisories to patch vulnerabilities.

-

Beware of Scams: Ignore unsolicited requests for your private key, seed phrase, or funds. Scammers often pose as support teams or promise “free crypto.”

Common Risks and How to Mitigate Them

-

Phishing Scams: Hackers create fake wallet apps or websites to steal keys. Mitigation: Verify URLs and download from official sources.

-

Address Errors: Sending to the wrong or incompatible address results in permanent loss. Mitigation: Use QR codes and test transactions.

-

Hacks: Hot wallets are vulnerable to malware or compromised devices. Mitigation: Use cold wallets for large holdings and keep devices malware-free.

-

Lost Keys: Losing your private key or seed phrase locks you out of your funds. Mitigation: Store multiple offline backups.

-

Exchange Risks: Custodial wallets on exchanges (e.g., Binance) are targets for hacks. Mitigation: Move funds to a non-custodial wallet after purchase.

The Crypto Landscape in 2025

As of August 3, 2025, the crypto market is more accessible, with exchanges like Coinbase and Binance offering user-friendly interfaces for buying and sending crypto.

Hot wallets like MetaMask and Trust Wallet are popular for DeFi and NFT transactions, while hardware wallets like Ledger and Trezor dominate for secure storage.

High-profile hacks, like those in the past, underscore the importance of non-custodial wallets and robust security practices. With growing adoption in payments, DeFi, and remittances, secure transaction methods are critical for protecting assets.

Getting Started with Secure Transactions

-

Choose a Wallet: Start with a hot wallet (e.g., Trust Wallet) for small transactions or a cold wallet (e.g., Ledger) for larger amounts.

-

Practice with Small Amounts: Send and receive $10–$20 of BTC or ETH to learn the process.

-

Secure Your Setup: Record your seed phrase offline, enable 2FA, and use trusted platforms.

-

Learn More: Explore resources like Binance Academy, CoinDesk, or Mastering Bitcoin by Andreas Antonopoulos for deeper insights.

-

Join Communities: Follow X or Reddit’s r/cryptocurrency for tips and scam alerts, but verify information independently.