Bitcoin Mining Difficulty Hits All-Time High in 2025

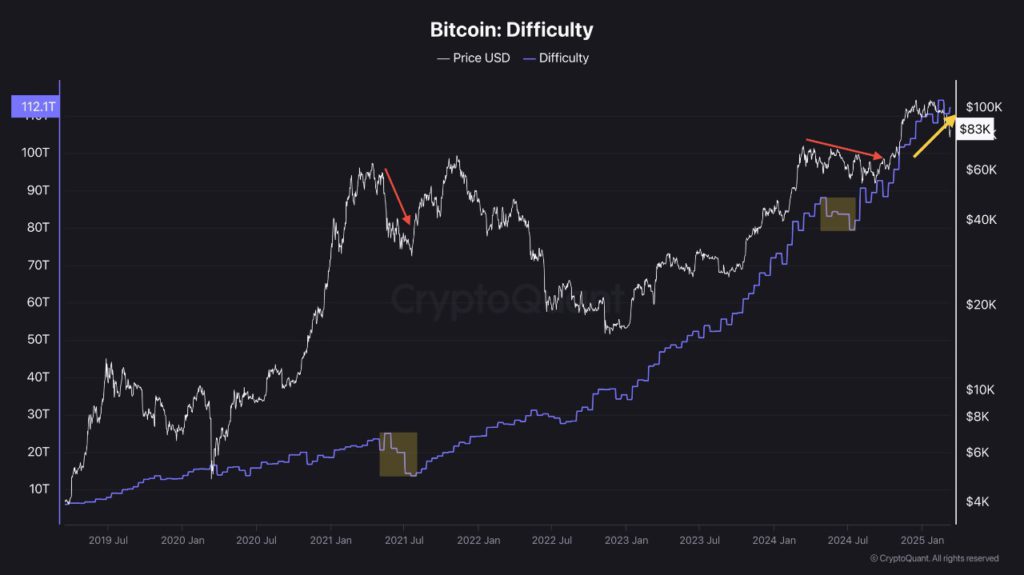

In 2025, Bitcoin (BTC) mining difficulty reached an unprecedented peak, hitting 127.6 trillion, as reported on August 3, 2025, reflecting the immense computational power now securing the Bitcoin network.

This milestone underscores the growing competition among miners and the robustness of Bitcoin’s decentralized system.

As of August 3, 2025, with Bitcoin trading between $50,000 and $80,000, this surge in difficulty has significant implications for miners, investors, and the broader crypto ecosystem.

This article explores the reasons behind the all-time high in Bitcoin mining difficulty, its impact on the market, and what it means for the future of Bitcoin.

What Is Bitcoin Mining Difficulty?

Bitcoin mining difficulty measures how challenging it is for miners to find a valid hash for a new block on the Bitcoin blockchain.

It adjusts automatically every 2,016 blocks (approximately every two weeks) to maintain an average block time of 10 minutes.

A higher difficulty indicates more computational power (hashrate) is required to solve the complex mathematical puzzles that validate transactions and earn block rewards.

This self-regulating mechanism ensures Bitcoin’s predictable issuance and protects its scarcity, a key feature of its value proposition as “digital gold.”

How Difficulty Works

-

Hashrate Influence: As more miners join the network or deploy advanced hardware, the hashrate (total computational power) increases, raising difficulty to slow block production.

-

Adjustment Mechanism: If the hashrate drops (e.g., miners leave due to unprofitability), difficulty decreases to maintain the 10-minute block interval.

-

Stock-to-Flow Ratio: Bitcoin’s difficulty adjustments maintain its high stock-to-flow ratio (currently ~120, twice that of gold), ensuring low new supply and price stability.

The 2025 Milestone: 127.6 Trillion

Bitcoin’s mining difficulty surged to an all-time high of 127.6 trillion in early August 2025, driven by a record hashrate of 933.61 exahashes per second (EH/s).

This peak followed a year of intense miner activity, with nine difficulty increases and five decreases in 2025, resulting in a net 32.24% gain year-to-date. Key factors contributing to this milestone include:

1. Surging Hashrate

-

The seven-day average hashrate reached 918–933.61 EH/s in 2025, nearing its all-time peak of 925 EH/s.

-

Miners deployed newer, more efficient Application-Specific Integrated Circuits (ASICs), boosting computational power.

-

Public mining companies like CleanSpark and MARA expanded operations, with CleanSpark reaching 45.6 EH/s and MARA mining 950 BTC in May 2025.

2. Post-Halving Dynamics

-

The April 2024 Bitcoin halving reduced block rewards from 6.25 BTC to 3.125 BTC, increasing miners’ reliance on transaction fees and higher BTC prices for profitability.

-

Despite lower rewards, Bitcoin’s price recovery (from $17,000 in 2022 to $50,000–$80,000 in 2025) attracted new miners, driving hashrate and difficulty higher.

3. Technological Advancements

-

Innovations in mining hardware, such as next-generation ASICs, improved efficiency, allowing miners to contribute more hashrate with lower energy costs.

-

Access to low-cost energy sources, particularly for large-scale miners, sustained profitability despite rising difficulty.

4. Institutional and Corporate Involvement

-

Public miners like MARA accumulated 49,179 BTC as treasury assets, signaling long-term confidence in Bitcoin’s value.

-

Institutional adoption, including Bitcoin ETFs and corporate treasury strategies, bolstered miner optimism, encouraging investment in mining infrastructure.

Impact on Miners

The record-high difficulty has significant implications for Bitcoin miners:

-

Increased Costs: Higher difficulty requires more computational power and energy, raising operational costs. Miners with outdated hardware or high energy costs face tighter margins.

-

Consolidation: Smaller miners may exit or merge with larger operations, as only those with efficient equipment and cheap energy remain competitive.

-

Profitability Pressures: With hashprice (revenue per unit of hashrate) at $58.67 and transaction fees low (~2 sat/vB or $0.30), miners rely on Bitcoin’s price appreciation to stay profitable.

-

Strategic Shifts: Some miners, like MARA, diversify into high-performance computing (HPC) or lend BTC for yield, while others hold mined coins as treasury assets.

Despite these challenges, a projected 3% difficulty drop to ~123.7 trillion on August 9, 2025, could offer temporary relief by making block rewards easier to earn.

Impact on the Bitcoin Network

The all-time high difficulty strengthens Bitcoin’s ecosystem:

-

Enhanced Security: A higher hashrate makes the network more resistant to 51% attacks, reinforcing trust in Bitcoin’s decentralization.

-

Scarcity Preservation: Difficulty adjustments maintain Bitcoin’s stock-to-flow ratio, with ~94% of its 21 million BTC already mined, supporting its value as a scarce asset.

-

Market Sentiment: Rising difficulty signals miner confidence, often correlating with bullish price trends, as seen in past cycles (e.g., 2021 bull run).

However, low on-chain activity (e.g., minimal transaction fees) suggests a divergence between mining infrastructure growth and network usage, which could temper short-term price gains.

Implications for Investors

For crypto investors, the record difficulty has mixed implications:

-

Bullish Signal: Historically, rising difficulty and hashrate precede bull runs, as seen in 2021 when nine consecutive positive adjustments coincided with Bitcoin’s $69,000 peak.

-

Price Pressure: Higher difficulty reduces miner profitability, potentially leading to sell-offs if prices stagnate. For example, 30,000 BTC left miner wallets from November 2023 to July 2024 during unprofitable periods.

-

Long-Term Confidence: Long-term holders (LTHs) show a 357% profit ratio in July 2025, with minimal selling, indicating strong conviction in Bitcoin’s value.

Investors using strategies like Dollar-Cost Averaging (DCA) can capitalize on volatility, buying during dips to offset potential corrections.

The Crypto Landscape in 2025

As of August 3, 2025, Bitcoin’s mining difficulty reflects a maturing market. The network’s hashrate growth, driven by technological advancements and institutional involvement, underscores Bitcoin’s resilience post-2024 halving.

However, miners face challenges from rising costs and low transaction fees, while investors navigate a market influenced by global liquidity and Ethereum ETF growth.

A projected difficulty drop on August 9 offers short-term relief, but the long-term trend remains upward, signaling robust network health.

What to Do as a Crypto Enthusiast

-

Stay Informed: Monitor difficulty and hashrate trends using platforms like CoinWarz, CryptoQuant, or Blockchain.com.

-

Invest Wisely: Use DCA to mitigate volatility, focusing on Bitcoin’s long-term value as a scarce asset.

-

Secure Assets: Store BTC in a hardware wallet (e.g., Ledger Nano X) to protect against exchange risks. Back up seed phrases offline.

-

Understand Cycles: Recognize that difficulty spikes often precede price rallies, but short-term corrections are possible.

-

Explore Mining: For advanced users, research cloud mining or low-cost energy solutions, but beware of high costs and scams.